How Retirement Income is Taxed

Today we are covering a question on taxes and retirement from our planning community that comes up a lot.

How will my FERS basic annuity be taxed when I start receiving benefits?

We’ll look at the answer, and provide some information on how Social Security, the TSP, and other investment income may be taxed as well.

FERS Basic Annuity

The FERS pension is taxable as ordinary income and most of the benefits, generally somewhere around 90%-98%, are taxable.

There is a small non-taxable amount within a retirement annuity payment that is considered a return of premium from employee contributions to the annuity. The rest of the benefit amount is taxable, coming from agency contributions on your behalf.

A quick refresher on FERS Basic Annuity employee contributions:

- FERS employees hired before 2013 contribute 0.8% of base pay

- FERS employees hired between 1/1/2013 – 12/31/2013 [RAE] = 3.1% of base pay

- FERS employees hired 1/1/2014 – present [FRAE] = 4.4% of base pay

- Employees hired pre 2013 contribute less than 1% of salary to the FERS basic annuity benefit, while rates have been increased by recent legislation for new hires.

The contributions employees make are added up and returned little by little over life expectancy within annuity payments.

It may be interesting to see how non-taxable percentages change when RAE and FRAE employees with higher contribution rates start to retire in the future - less of the benefit amount (as %) may be taxable because more will be coming back as a return of employee premiums paid.

What about the FERS special retirement supplement?

The Special Retirement Supplement {SRS) is payable to an employee who has completed at least one calendar year of FERS service when reaching MRA and payable until social security begins at age 62.

The supplement approximates the value of FERS service to a Social Security benefit – it provides a portion of income prior to 62 similar to what the employee would have received by retiring at 62 and applying for Social Security benefits.

The SRS is 100% taxable as ordinary income.

There's also an earnings test that applies. If you go back to work after leaving your federal career and have earned income - if you make more than $19,560 a year (FY2023), you will start to lose some of your benefits from the special retirement supplement. Something to keep in mind.

Social Security Income

If you're receiving a substantial FERS pension, your Social Security benefits are more than likely going to be taxable - and generally 85% of benefits are taxable.

If you file as an individual and combined income is:

- Between $25,000 - $34,000 you may have to pay income tax on up to 50% of benefits

- More than $34,000 , up to 85% of your benefits may be taxable.

If you file a joint return and combined income is:

- Between $32,000 - $44,000 you may have to pay income tax on up to 50% of benefits

- More than $44,000, up to 85% of your benefits may be taxable.

*Info via SSA.GOV

This applies to the Federal income tax level. Some states exclude Social Security income from taxation, sometimes this is a factor for people considering relocating to another state in retirement.

Thrift Savings Plan

The TSP account has two accounts to consider – Traditional and Roth.

Money coming out of a traditional TSP account is 100% taxable. This type of contribution receives a tax deduction, the account grows tax deferred, and when you take money out, it’s 100% taxable as ordinary income.

The Roth account receives after-tax contributions that may grow tax-free if making a qualified withdrawal. A qualified withdrawal is defined as where an account has been open for five years and the owner is over the age of 59.5.

There are several factors that may determine how much of your contributions you should put into each of these two account types. The big picture is that tax allocation matters when considering efficiency within your tax situation for retirement income.

One other point on the TSP. Required minimum distributions apply to the traditional TSP - that means when you hit a certain age, each year you're required to take out a percentage of your account based on a life expectancy table. Currently that amount starts around 3.77% (based on age 73 RMD start) and increases every year as life expectancy decreases. For instance, a $2 million TSP that would be required to withdraw 3.77% (based on the uniform table), would be equivalent to a $75,400 distribution that would be taxable ordinary income.

As of 2024 the Roth TSP is no longer subject to RMD requirements.

Other Investments

Last item to touch on today is the taxability of other types of investments

If you own a taxable investment account, this type of investment can be considered pay-as-you-go. That simply means if you receive income during the year from a dividend, a capital gain distribution, or you sell an investment for a capital gain - you pay tax on the taxable amount of transaction in the year it takes place.

This creates what is called a cost basis - basically your account is partially paid up based on the amounts of account value tax has been paid on.

Depending on what type of investments you're holding – something that pay dividends consistently, or if you trade frequently, more or less of your account balance may have already been taxed.

This type of account is another piece in the tax diversification puzzle, it may provide flexibility when it comes to planning and where you're going to take money from within retirement.

We talk about tax diversification all the time because we want to be able to pull money from all three of these buckets - Traditional, Roth, and Taxable accounts. This provides a chance at a better tax footprint, where we pay our fair share and hopefully no more.

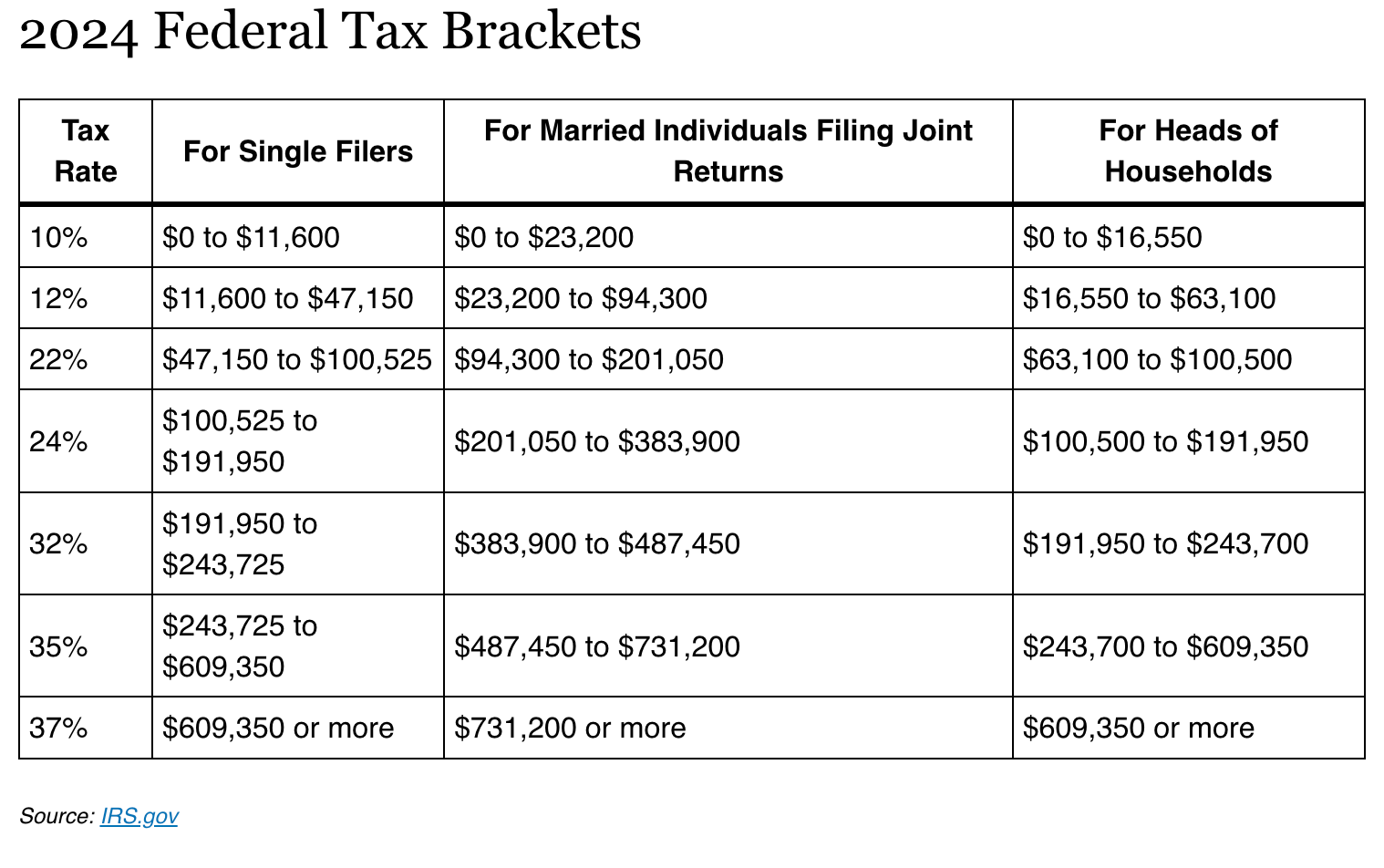

A big part of this is avoiding being pushed into a higher tax bracket.

Let's take a look at a simple example involving required minimum distributions.

Let's say you had $36,000 a year coming in from your FERS pension or $3,000 a month, and you also had another $6,000 a month or $72,000 from Social Security income between you and your spouse.

Right off the bat those two amounts put you at $108,000 in taxable income and in the 22% tax bracket based on those two sources of income. Now, maybe you had $15,000 in income from a taxable investment account and $10,000 from some other earned income source. What happens when your RMD hits or you have large distributions from a pretax account? It's going to continue to build in your tax bracket or move you into a higher one.

If you had that $2 million TSP and were required to take $75,000 out of it. Now you're talking about going up into the next tax bracket right here. You can see how it's may be pretty easy to stay in the tax bracket you're in before you retire or even above that based on retirement income with a pension, Social Security, TSP distributions, and other investment accounts, etc..

I hope you’ve found this information on retirement income helpful. I would encourage you to take the time to review all your potential retirement income sources so that you can make the best decisions for your personal circumstances.

I also publish a biweekly newsletter with insights into topics like this and more. If you’d like to join the list, please subscribe here.

Don’t be afraid to ask questions. I’m here to help.

-Justin

*The content is developed from sources believed to be providing accurate information.

This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal or investment advice. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own separate from this educational material